Thinking about retirement planning? A Gold IRA could be the path you've been looking for. Gold has historically served as a stable asset, and diversifying your portfolio with precious metals can hedge against market volatility. A Gold IRA offers a beneficial tax framework for investing in physical gold, which increases the value proposition of your retirement savings.

- Explore a Gold IRA if you're seeking to:

- Allocate your retirement portfolio

- Safeguard your wealth from market fluctuations

- Gain a hedge against potential downturns

It's essential to research before making any financial choices.

Achieving Wealth Through a Gold IRA Strategy

In today's volatile market, savvy investors are seeking alternative avenues to secure their wealth. A Gold IRA, or Individual get more info Retirement Account, offers a compelling opportunity to diversify your portfolio and minimize risk. By investing in physical gold within an IRA, you can shield your savings from inflation and economic volatility. This unique investment option allows you to harness the historical stability of gold while enjoying the tax advantages of a traditional IRA.

- Explore a Gold IRA if you're seeking to balance your portfolio and preserve your hard-earned savings.

- Speak with a qualified financial advisor to understand if a Gold IRA is the right approach for your individual needs and goals.

Steps to Developing a Well-Rounded Portfolio with a Gold IRA

A Gold IRA is an excellent mechanism for broadening your retirement portfolio. By incorporating precious metals like gold, you can lower risk and potentially enhance returns. However, building a strong Gold IRA involves careful consideration.

- Begin by| Meticulously evaluating your financial goals and risk tolerance.

- Following, research different Gold IRA providers to locate a reputable and dependable one.

- Furthermore, evaluate the multiple gold options available, such as physical gold bars, coins, or ETFs.

- Lastly, periodically review your portfolio performance and make changes as needed.

By following these guidelines, you can develop a diversified Gold IRA portfolio that aligns with your investment objectives.

Maximize Returns: The Power of a Gold IRA Investment

A self-directed IRA offers an efficient way to grow your retirement savings. Gold, lauded for its historical stability, can serve as a valuable supplement to your portfolio, perhaps mitigating risk and improving returns. By allocating your assets into physical gold through a Gold IRA, you gain access to a concrete asset that consistently performs well during financial instability.

- Evaluate the benefits of a Gold IRA to preserve your financial future.

- Engage a qualified financial advisor to evaluate if a Gold IRA is the right investment for your specific needs and goals.

Investing in Gold for Retirement: A Step-by-Step Guide

Planning your retirement involves meticulously considering various financial options. Gold has long been seen as a stable store of value, possibly making it an attractive choice for your retirement portfolio.

- Start by assessing your investment goals and risk tolerance.

- Establish the percentage of your portfolio you wish to devote to gold.

- Research different ways for acquiring gold, such as physical coins, gold ETFs, or mining companies.

- Evaluate the expenses associated with each choice.

- Balance your holdings across different asset types to manage risk.

Periodically review your financial strategy and make adjustments as needed. Seeking advice from a qualified financial advisor can provide valuable support throughout the journey.

A Comprehensive Guide to Gold IRAs & Precious Metals

Unlocking the potential of gold investments within your retirement strategy can be a intelligent move. Gold IRAs, in particular, offer a valuable avenue for preserving wealth in market volatility. This thorough guide will delve into the ins and outs of Gold IRAs and precious metals, providing you with the expertise needed to make informed decisions about your financial future.

- Uncover the advantages of investing in Gold IRAs and how they complement a diversified portfolio.

- Learn the different types of precious metals suitable for IRA investments, including gold, silver, platinum, and palladium.

- Identify reputable Gold IRA companies that align with your needs

From selecting the right precious metals to comprehending the investment implications, this guide will equip you with the tools and information necessary to embark on your Gold IRA journey with confidence.

Tony Danza Then & Now!

Tony Danza Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now! Jeremy Miller Then & Now!

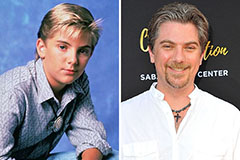

Jeremy Miller Then & Now! Matilda Ledger Then & Now!

Matilda Ledger Then & Now!